Introduction

Bitcoin has taken the financial world by storm, offering a decentralized and innovative way to manage money. However, with its rise in popularity, numerous myths and misconceptions have also emerged. Debunking Bitcoin myths is essential to clear up confusion and hesitation among potential users and investors. In this blog, we will debunk some of the most common Bitcoin myths, providing clear and accurate information to help you better understand this revolutionary digital currency. Understanding the realities of Bitcoin can empower you to make informed decisions and fully leverage its benefits.

Myth 1: Bitcoin is Only Used for Illegal Activities

One of the most popular myths about Bitcoin is that it is predominantly used for illegal transactions due to its pseudonymous nature. This myth has been fueled by early incidents involving Bitcoin and darknet markets.

- Facts About Legitimate Bitcoin Use: While Bitcoin has been used in illegal activities, the vast majority of transactions are for legitimate purposes. Bitcoin is accepted by many reputable businesses and institutions worldwide, ranging from small online retailers to major corporations like Microsoft and Overstock. Charities and non-profits also accept Bitcoin donations, highlighting its legitimacy and broad acceptance.

- Regulatory Measures in Place: Governments and regulatory bodies worldwide have implemented measures to monitor and regulate Bitcoin transactions. These regulations include anti-money laundering (AML) and know your customer (KYC) requirements that financial institutions and cryptocurrency exchanges must follow. This regulatory framework helps prevent illegal use and promotes the legitimate adoption of Bitcoin. Additionally, blockchain analytics companies can track suspicious activities, further ensuring the lawful use of Bitcoin.

Myth 2: Bitcoin is Not Secure

Another common myth is that Bitcoin is inherently insecure and prone to hacks and fraud. This belief often stems from high-profile cases where exchanges were compromised.

- Explanation of Blockchain Technology: Bitcoin’s security is rooted in blockchain technology, a decentralized ledger that records all transactions. Each transaction is verified by a network of nodes and added to a block, which is then linked to the previous block, forming a chain. This technology makes it extremely difficult for any single entity to alter or tamper with transaction records. The decentralized nature of the blockchain ensures that there is no central point of failure, making Bitcoin highly secure.

- How to Enhance Security Measures: Users can enhance their security by adopting best practices such as using hardware wallets, enabling two-factor authentication (2FA), and utilizing non-custodial platforms like Bitfly, which allow users to retain control over their private keys. Hardware wallets store private keys offline, protecting them from online threats. Two-factor authentication adds an extra layer of security by requiring a second form of verification in addition to a password. You can also read our blog How to Secure Bitcoin to know more about its security.

Myth 3: Bitcoin Has No Real Value

Skeptics often argue that Bitcoin has no intrinsic value and is merely a speculative asset. This myth is particularly persistent among those who are unfamiliar with how Bitcoin operates.

- Factors That Contribute to Bitcoin’s Value: Bitcoin’s value is derived from several factors. First, its scarcity – only 21 million Bitcoins will ever exist – creates a supply constraint that can drive value. Second, its utility as a decentralized digital currency allows for peer-to-peer transactions without intermediaries. Third, the security and transparency provided by blockchain technology instill trust among users. Additionally, the growing acceptance and adoption of Bitcoin by businesses and institutions further enhance its value.

- Comparison with Traditional Assets: Like gold and fiat currencies, Bitcoin’s value is also based on market demand and the trust of its users. Gold has intrinsic value due to its physical properties and limited supply. Similarly, fiat currencies derive value from the trust and backing of governments. Bitcoin, although digital, shares these characteristics of scarcity and trust. It serves as a store of value and a medium of exchange, similar to traditional assets. Moreover, Bitcoin’s portability and divisibility make it a versatile asset in the digital age.

Looking to buy Bitcoin quickly and securely? Join Bitfly now for hassle-free Bitcoin transactions with top-notch security and speed. Start today!

Myth 4: Bitcoin is a Bubble

The rapid price increases and volatility have led some to label Bitcoin as a bubble destined to burst. This myth often arises during periods of significant price fluctuations.

- Analysis of Historical Trends: Bitcoin has experienced several price bubbles and corrections over its history. Each time, it has rebounded stronger, indicating resilience and growing adoption. For instance, after the 2017 bull run and subsequent crash, Bitcoin eventually recovered and reached new all-time highs in 2020 and 2021. These cycles of growth and correction are common in emerging technologies and markets.

- Expert Opinions on Bitcoin’s Future: Many financial experts and analysts believe that Bitcoin is here to stay. Its underlying technology, coupled with the increasing interest from institutional investors, suggests a promising future. Major financial institutions such as BlackRock, Fidelity and Grayscale have launched Bitcoin investment products (Bitcoin ETFs), reflecting their confidence in its long-term potential. Additionally, Bitcoin’s role as a hedge against inflation and economic instability further cements its place in the financial landscape.

Myth 5: Bitcoin Transactions are Slow and Expensive

There is a belief that Bitcoin transactions are inherently slow and come with high fees, making it impractical for everyday use.

- Technological Advancements Improving Transaction Speed and Cost: Innovations like the Lightning Network are designed to speed up Bitcoin transactions and reduce fees. The Lightning Network is a layer-2 solution that enables off-chain transactions, significantly increasing the transaction throughput and reducing costs. These advancements are continuously improving the efficiency of the Bitcoin network, making it more suitable for everyday transactions.

Myth 6: Bitcoin is Bad for the Environment

Critics often highlight Bitcoin’s energy consumption as a significant environmental concern, arguing that it is unsustainable.

- Understanding Bitcoin’s Energy Use: Bitcoin mining requires substantial energy to power the computers that solve complex mathematical problems and secure the network. However, it’s important to consider the sources of this energy. A growing percentage of Bitcoin mining operations are powered by renewable energy sources, such as hydro, wind, and solar power.

- Efforts to Improve Sustainability: The Bitcoin community is increasingly focused on improving sustainability. Innovations such as more efficient mining hardware, the use of stranded energy (energy that would otherwise go to waste), and carbon offset programs are helping to reduce Bitcoin’s environmental impact. Additionally, some mining operations are relocating to regions with abundant renewable energy, further mitigating their carbon footprint.

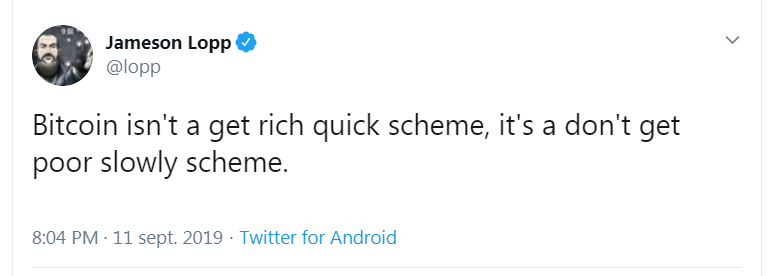

Myth 7: Bitcoin is a Get-Rich-Quick Scheme

The media often portrays Bitcoin as a quick way to make a fortune, leading to the misconception that it is a get-rich-quick scheme.

- Realities of Bitcoin Investment: While some early adopters have made significant profits, Bitcoin investment comes with risks and volatility. Prices can fluctuate wildly, and investors should be prepared for potential losses as well as gains. A balanced approach to investment, including diversification and long-term holding, can help manage these risks.

- Educating New Investors: It’s essential for new investors to educate themselves about Bitcoin and the cryptocurrency market. Understanding the technology, market dynamics, and investment strategies can help them make informed decisions and avoid falling for hype or scams.

Myth 8: Bitcoin is Too Complex for the Average Person

The perception that Bitcoin is too complex and technical can deter people from using it.

- Simplifying Bitcoin for Everyone: While Bitcoin’s underlying technology is complex, using Bitcoin is becoming increasingly user-friendly. Wallets, exchanges, and platforms like Bitfly are designed with intuitive interfaces that make buying, selling, and managing Bitcoin straightforward. Educational resources and customer support also help demystify the process for new users.

- Bitfly’s User-Friendly Approach: Bitfly is committed to making Bitcoin accessible to everyone. Its platform offers easy-to-navigate features, comprehensive guides, and responsive customer support to ensure that even those new to cryptocurrency can confidently engage with Bitcoin.

Conclusion

Debunking these common myths helps to clear up misunderstandings and reveals the true potential of Bitcoin. As with any financial asset, it’s essential to do your research and make informed decisions. Bitcoin is a versatile and secure digital currency with a promising future. By understanding the realities behind these myths, you can confidently explore the world of Bitcoin and make the most of its benefits.

Bitfly is committed to providing a secure, fast, and user-friendly platform for Bitcoin transactions, helping users navigate the world of cryptocurrency with confidence. Our platform’s non-custodial security, lightning-fast transactions, and excellent customer support make it an ideal choice for both new and experienced users.

Explore Bitfly today and experience the benefits of a platform designed to make Bitcoin transactions easy and secure. Don’t let myths hold you back—discover the real value and potential of Bitcoin with Bitfly.

![]()