Introduction

As the cryptocurrency market continues to evolve, Bitcoin remains at the forefront as the most prominent and influential digital asset. Understanding the market trends for Bitcoin in 2024 is crucial for investors, traders, and enthusiasts looking to navigate the complexities of this dynamic market. In this blog, we will explore the key trends shaping the Bitcoin market in 2024, including macroeconomic factors, regulatory developments, technological advancements, adoption rates, market sentiment, and expert predictions. By staying informed about these trends, you can make more informed decisions and better position yourself in the ever-changing world of Bitcoin.

Macroeconomic Factors Influencing Bitcoin

Global Economic Conditions

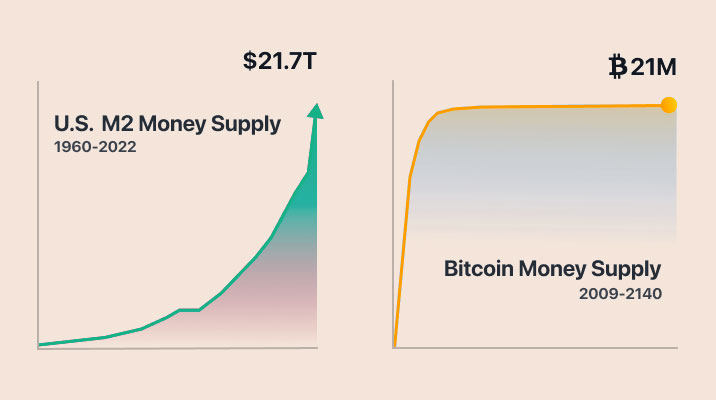

- Inflation and Monetary Policies: In 2024, global economic conditions such as inflation rates and central bank policies will significantly impact Bitcoin’s price. High inflation in traditional fiat currencies can drive investors to seek Bitcoin as a hedge against currency devaluation.

- Economic Growth and Recession Risks: Economic growth or recession risks in major economies can influence Bitcoin demand. During economic uncertainty, Bitcoin is often viewed as a store of value and a safe haven asset.

Impact of Interest Rates and Inflation on Bitcoin

- Interest Rates: Central banks’ decisions on interest rates can affect Bitcoin’s price. Higher interest rates may lead to reduced liquidity and lower investment in risk assets like Bitcoin, while lower rates could increase investment flows into cryptocurrencies.

- Inflation: Persistent inflation can boost Bitcoin’s appeal as an inflation hedge. As fiat currencies lose purchasing power, Bitcoin’s fixed supply and decentralized nature make it an attractive alternative.

Case Studies of Macroeconomic Impact on Bitcoin

- 2021-2023 Trends:

- Inflation and Economic Uncertainty: During this period, Bitcoin saw a significant price increase as investors sought a hedge against inflation and economic instability. The U.S. Federal Reserve’s monetary policies, including low-interest rates and quantitative easing, led to concerns about fiat currency devaluation, driving more investors towards Bitcoin.

- COVID-19 Pandemic (2020-2022):

- Market Volatility and Safe Haven Appeal: The global economic turmoil caused by the COVID-19 pandemic led to unprecedented market volatility. Bitcoin initially saw a sharp decline in March 2020, followed by a rapid recovery and subsequent bull run. Investors viewed Bitcoin as a safe haven asset amid economic uncertainty, contributing to its rising demand and price surge.

- 2017 Bull Run and Subsequent Correction:

- Speculative Investment and Market Sentiment: The 2017 Bitcoin bull run was largely driven by speculative investment and positive market sentiment. However, the lack of regulatory clarity and fears of a bubble led to a significant market correction in early 2018. This period highlighted the impact of market psychology and speculative behavior on Bitcoin’s price.

- SEC Lawsuits Against Major Crypto Exchanges (2023):

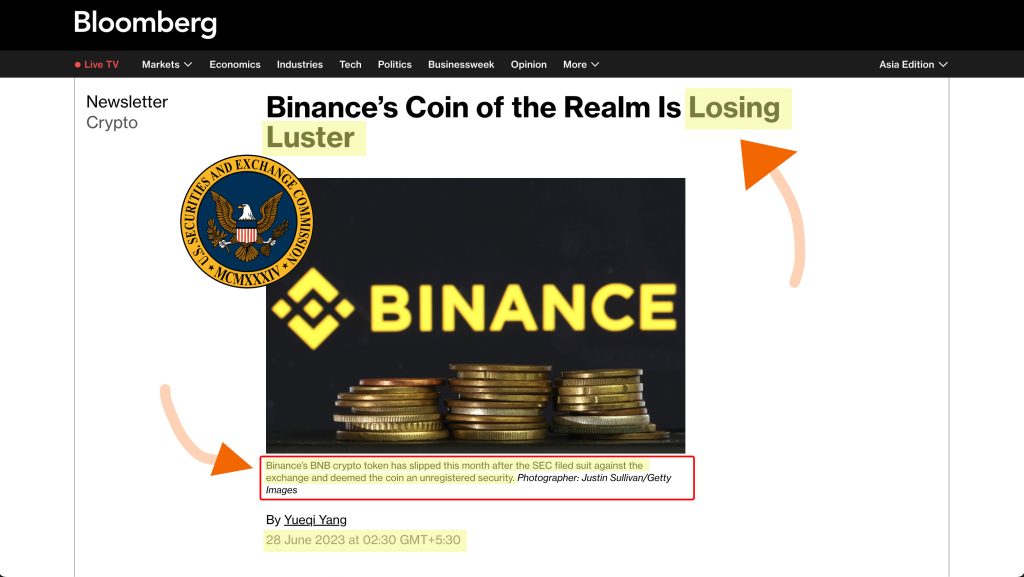

- Regulatory Crackdown and Market Response: In mid-2023, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against major cryptocurrency exchanges, including Binance and Coinbase, alleging violations of securities laws. These legal actions created significant uncertainty in the market, leading to increased volatility and a temporary decline in Bitcoin prices. The lawsuits prompted exchanges to enhance compliance measures and sparked a broader debate on regulatory clarity in the cryptocurrency industry. Despite the initial negative impact, Bitcoin’s price recovered as investors gained confidence in the market’s resilience and the ongoing efforts to establish clear regulatory frameworks.

- Regulatory Crackdown and Market Response: In mid-2023, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against major cryptocurrency exchanges, including Binance and Coinbase, alleging violations of securities laws. These legal actions created significant uncertainty in the market, leading to increased volatility and a temporary decline in Bitcoin prices. The lawsuits prompted exchanges to enhance compliance measures and sparked a broader debate on regulatory clarity in the cryptocurrency industry. Despite the initial negative impact, Bitcoin’s price recovered as investors gained confidence in the market’s resilience and the ongoing efforts to establish clear regulatory frameworks.

Regulatory Developments

Current Regulatory Landscape

- United States: The U.S. regulatory environment is critical for Bitcoin’s future. Ongoing discussions around cryptocurrency taxation, SEC regulations, and potential ETF approvals will shape the market.

- Europe: The European Union’s approach to cryptocurrency regulation, including the Markets in Crypto-Assets (MiCA) regulation, will impact Bitcoin’s adoption and usage across Europe.

- Asia: Countries like China and India have fluctuated between strict regulations and openness towards Bitcoin. Monitoring their regulatory stances will be essential for understanding regional market dynamics.

Predicted Regulatory Changes in 2024

- Stablecoin Regulations: As stablecoins gain prominence, new regulations could emerge, indirectly affecting Bitcoin by influencing the broader cryptocurrency market.

- Taxation Policies: Changes in how cryptocurrencies are taxed could impact investment strategies and market behavior.

Impact of Regulations on Bitcoin Market

- Adoption and Investment: Clear and favorable regulations can encourage institutional and retail investment in Bitcoin. Conversely, restrictive regulations could hinder market growth.

- Market Stability: Regulatory clarity can reduce market volatility by providing a more predictable investment environment.

Technological Advancements

Bitcoin Network Upgrades

- Taproot and Schnorr Signatures: Enhancements like Taproot and Schnorr signatures aim to improve Bitcoin’s privacy, efficiency, and scalability.

- Layer 2 Solutions: Technologies such as the Lightning Network continue to evolve, enabling faster and cheaper transactions on the Bitcoin network.

Innovations in Blockchain Technology

- Cross-Chain Interoperability: Developments in interoperability solutions can facilitate seamless transactions between Bitcoin and other blockchain networks.

- Smart Contracts on Bitcoin: Projects enabling smart contract functionality on Bitcoin, such as RSK, are expanding Bitcoin’s use cases beyond a store of value.

Impact on Bitcoin’s Efficiency and Scalability

- Transaction Speed and Costs: Upgrades and layer 2 solutions are expected to enhance transaction speeds and reduce costs, making Bitcoin more practical for everyday use.

- Network Security: Continuous improvements in network security protocols will further protect Bitcoin from potential attacks and vulnerabilities.

Adoption Rates and Institutional Involvement

Retail Adoption Trends

- Payment Integration: More businesses are integrating Bitcoin as a payment option, increasing its use in everyday transactions.

- Awareness and Education: Increased efforts in Bitcoin education are helping more people understand and adopt Bitcoin.

Institutional Investment

- Institutional Funds and ETFs: The approval and growth of Bitcoin ETFs will make it easier for institutional investors to include Bitcoin in their portfolios.

- Corporate Adoption: Companies like Tesla and MicroStrategy holding Bitcoin on their balance sheets signal growing acceptance of Bitcoin as a reserve asset.

Impact of Increased Adoption on Market Dynamics

- Market Liquidity: Higher adoption rates and institutional involvement will likely increase market liquidity and stability.

- Price Volatility: While increased adoption can reduce volatility in the long term, short-term price swings may still occur as the market adjusts to higher levels of participation.

Market Sentiment and Public Perception

Influence of Social Media and Influencers

- Twitter, Reddit, and YouTube: Social media platforms play a significant role in shaping public perception and market sentiment towards Bitcoin.

- Influential Figures: Public statements by influential figures like Elon Musk can cause significant market movements.

Media Coverage and Public Opinion

- Mainstream Media: Positive or negative coverage in mainstream media impacts public opinion and investment behavior.

- Crypto News Outlets: Specialized crypto news outlets provide in-depth analysis and news, influencing the opinions of more informed investors.

Psychological Factors in Bitcoin Investing

- FOMO and FUD: Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) are powerful psychological drivers in the Bitcoin market.

- Market Cycles: Understanding market cycles and investor psychology can help in making more informed investment decisions.

Expert Predictions and Market Forecasts

Predictions from Leading Analysts

- Price Predictions: Analysts provide various price predictions based on technical analysis, market trends, and macroeconomic factors.

- Adoption Predictions: Predictions on how Bitcoin adoption will grow across different sectors and regions.

Bullish vs. Bearish Scenarios

- Bullish Case: Factors that could lead to significant price increases, such as institutional adoption, favorable regulations, and technological advancements.

- Bearish Case: Potential risks that could negatively impact Bitcoin, including regulatory crackdowns, technological failures, or macroeconomic downturns.

Long-Term vs. Short-Term Outlooks

- Short-Term: Analyzing market trends and events expected to impact Bitcoin in the coming months.

- Long-Term: Exploring Bitcoin’s potential over the next several years, including its role in the global financial system.

Conclusion

Staying informed about Bitcoin market trends in 2024 is essential for navigating the complexities of the cryptocurrency market. By understanding the impacts of macroeconomic factors, regulatory developments, technological advancements, adoption rates, market sentiment, and expert predictions, you can make more informed decisions and better position yourself for success. As Bitcoin continues to evolve, keeping a close eye on these trends will help you stay ahead in the ever-changing world of cryptocurrency.

Whether you are a seasoned investor or a newcomer to the Bitcoin space, understanding these trends will equip you with the knowledge to navigate the market confidently and strategically. Stay informed, stay vigilant, and embrace the exciting opportunities that the future of Bitcoin holds.

![]()