Introduction

Bitcoin, the first and most well-known cryptocurrency, has become a topic of great interest and discussion worldwide. Understanding Bitcoin is crucial as it lays the foundation for the entire cryptocurrency ecosystem. This blog post will delve into the origins of Bitcoin, how it works, its key characteristics, why it is valuable, how to use it, and its future prospects.

The Origin of Bitcoin

The Birth of Bitcoin

In 2008, the mysterious figure Satoshi Nakamoto unveiled Bitcoin by publishing a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document laid out the foundation for a decentralized digital currency. The first block of Bitcoin, called the “Genesis Block,” was mined by Nakamoto in January 2009, initiating the Bitcoin network.

Motivation Behind Bitcoin

The 2008 financial crisis highlighted critical weaknesses in the global financial infrastructure, eroding trust in conventional banks. Bitcoin emerged as a solution to these issues, designed to function independently of centralized entities and financial intermediaries. Its aim was to establish a decentralized, transparent, and secure method for value transfer.

How Bitcoin Works

Blockchain Technology

Blockchain technology, the backbone of Bitcoin, is a decentralized public ledger that logs all transactions. It consists of blocks, each containing transaction data, which are cryptographically linked to preceding blocks upon addition, ensuring data integrity and immutability.

Decentralization

Bitcoin functions through a decentralized network of nodes, which collectively uphold the blockchain. Without a central governing body, Bitcoin remains resistant to censorship and manipulation, highlighting its major advantage.

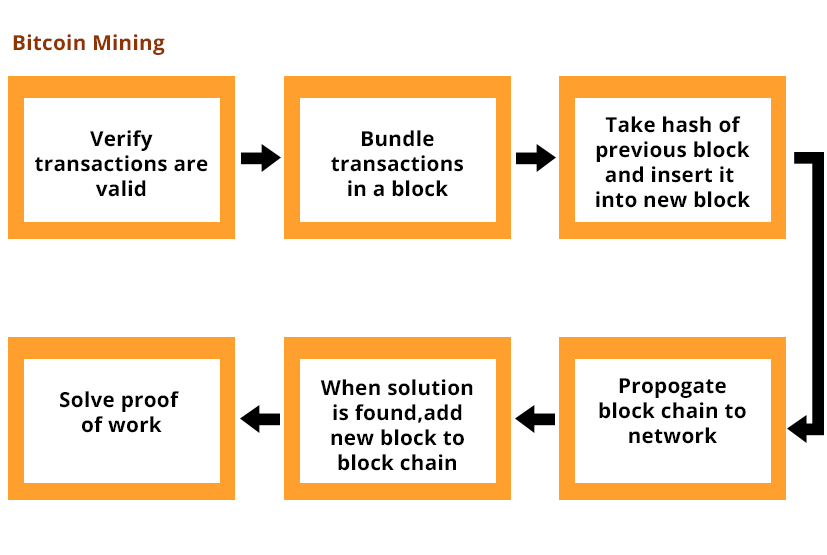

Bitcoin Mining

Bitcoin mining involves creating new Bitcoins and validating transactions. Miners employ high-powered computers to solve intricate mathematical puzzles, and the first to solve one adds a new block to the blockchain, known as proof of work. In return, miners receive newly generated Bitcoins and transaction fees, incentivizing the maintenance of the network.

Key Characteristics of Bitcoin

Digital and Decentralized

Bitcoin is entirely digital and can be electronically transferred between users. Its decentralized structure allows it to function without a central authority, establishing it as a global currency accessible to anyone with internet access.

Limited Supply

Bitcoin’s protocol caps its supply at 21 million coins to prevent inflation and maintain value. To date, roughly 19 million Bitcoins have been mined, with the remainder expected to be mined over the next few decades.

Pseudonymity

Transactions in Bitcoin are pseudonymous, with users identified by public keys rather than personal details. This provides some privacy, though not full anonymity, as all transactions are public on the blockchain and can potentially be traced back to individuals with sufficient effort.

Why Bitcoin is Valuable

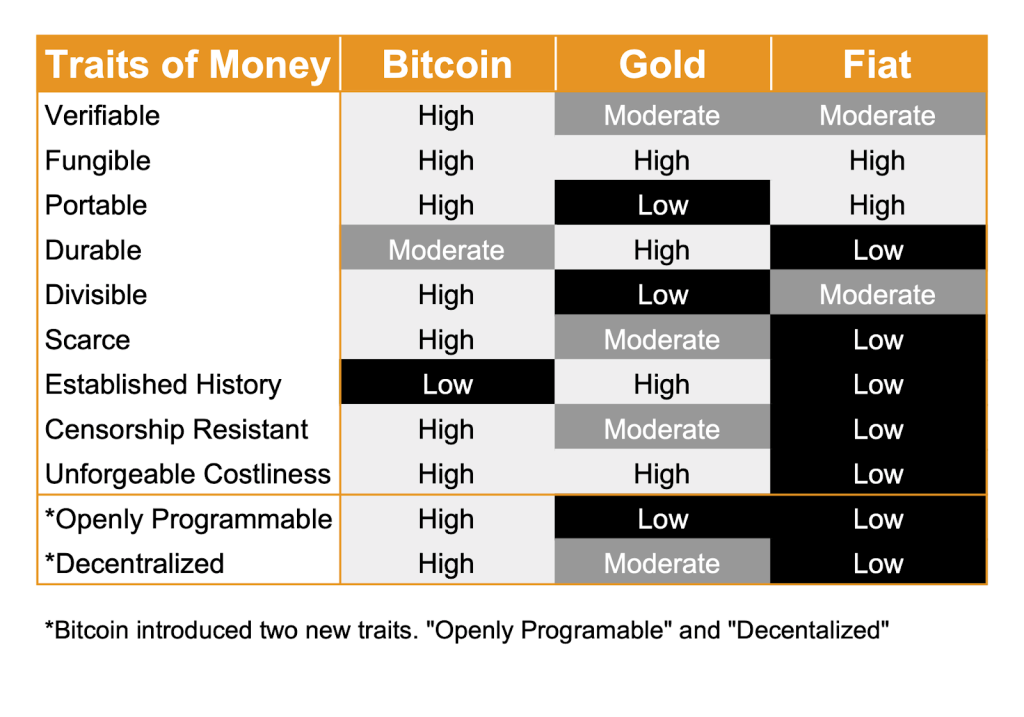

Store of Value

Often called “digital gold,” Bitcoin shares traits with physical gold, such as scarcity, durability, and divisibility, making it a compelling store of value. Investors often see Bitcoin as a hedge against economic instability and inflation.

Medium of Exchange

Bitcoin functions as a medium of exchange for various goods and services, with a growing number of merchants accepting it. Its borderless nature facilitates international transactions, typically with lower fees than conventional methods.

Hedge Against Inflation

In regions facing high inflation or economic turmoil, Bitcoin acts as a hedge against currency devaluation. Its decentralized nature protects it from government intervention, offering a secure means to preserve wealth.

How to Use Bitcoin

Buying and Selling Bitcoin

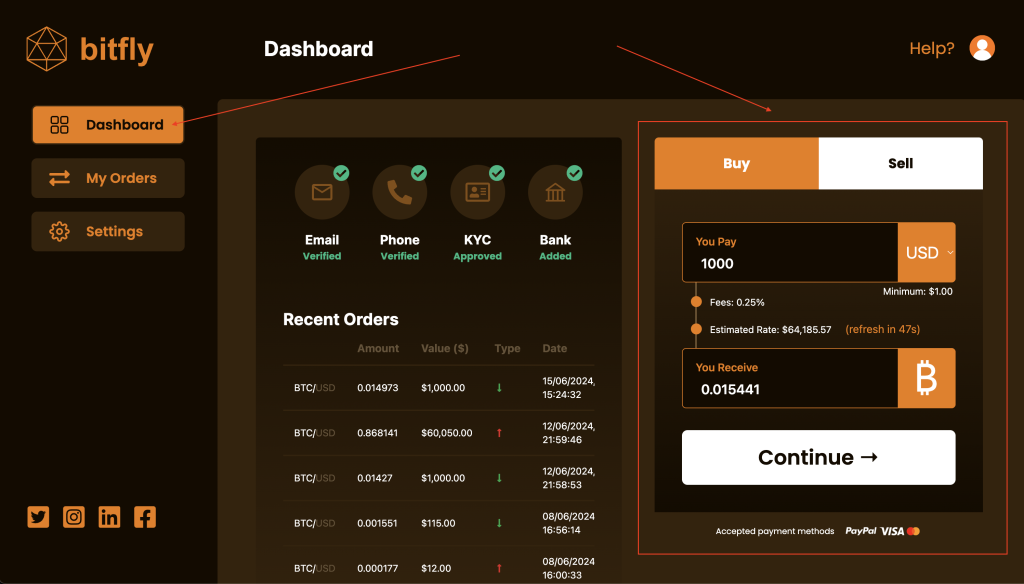

To buy Bitcoin, you need to use a cryptocurrency exchange like Bitfly. Here’s a quick overview of the process:

- Sign up on Bitfly and complete the verification process.

- Navigate to the Dashboard and enter the amount of Bitcoin you want to buy.

- Deposit funds using a bank transfer, credit card, or other supported methods.

- Confirm the transaction to complete the purchase.

Storing Bitcoin

Storing Bitcoin securely is crucial. Here are the types of wallets you can use:

- Hardware Wallets: These are physical devices that store Bitcoin offline, such as Ledger Nano S and Trezor.

- Software Wallets: Applications installed on your computer or mobile device, like Exodus and Electrum.

- Mobile Wallets: Smartphone apps offering a balance between convenience and security, such as Mycelium and Trust Wallet.

- Web Wallets: Online services that store your Bitcoin, like Coinbase and Blockchain.com.

Transacting with Bitcoin

Sending and receiving Bitcoin is straightforward:

- To send Bitcoin, enter the recipient’s Bitcoin address and the amount to send in your wallet.

- Confirm the transaction, and it will be broadcast to the Bitcoin network.

- The recipient will see the transaction once it is confirmed on the blockchain.

Understanding transaction fees and confirmations

- Transaction fees vary based on network congestion. Higher fees result in faster confirmations.

- Transactions are confirmed by miners and recorded on the blockchain. Multiple confirmations increase security.

The Future of Bitcoin

Adoption Trends

Bitcoin adoption is growing rapidly. More businesses and institutions are recognizing its potential and incorporating it into their operations. Some countries, like El Salvador, have even adopted Bitcoin as legal tender, highlighting its increasing acceptance.

Technological Developments

Bitcoin continues to evolve with technological advancements. The Lightning Network, for example, is a second-layer solution that enables faster and cheaper transactions by processing them off the main blockchain. Future upgrades aim to improve scalability, security, and functionality.

Regulatory Landscape

The regulatory environment for Bitcoin is constantly changing. While some governments embrace it, others remain cautious or even hostile. The future of Bitcoin regulation will significantly impact its adoption and use. Staying informed about regulatory changes is essential for Bitcoin users and investors.

Conclusion

Bitcoin is a revolutionary digital currency that offers a decentralized, secure, and global alternative to traditional financial systems. Understanding what Bitcoin is and how it works is the first step toward participating in the cryptocurrency ecosystem. Whether you’re looking to invest, use Bitcoin for transactions, or simply learn more, platforms like Bitfly provide the tools and resources to get started. Explore the world of Bitcoin today and join the growing community of crypto enthusiasts.

![]()